XRP, the native cryptocurrency of the Ripple Network, has maintained its position as one of the most valuable digital assets despite facing numerous challenges and significant regulatory scrutiny. With a market capitalization exceeding $23 billion, XRP continues to attract investors worldwide. Notably, the top holders of XRP are primarily centralized exchanges such as Binance, as well as Ripple itself.

If you’re intrigued by the captivating world of XRP, this exclusive article is tailor-made for you. Join us as we explore the 2023 XRP Rich List, dive into the depths of the blockchain, and uncover the wealthiest XRP whales who have amassed substantial fortunes by holding significant amounts of XRP at the time of writing.

Who is on the XRP rich list?

Monitoring the distribution and ownership patterns of the XRP cryptocurrency provides good insights into the overall health of the Ripple network. There are 4,559,305 active accounts participating in the XRP network as of the time of writing. The total available XRP is approximately 99,989,134,662, with a significant portion of it being controlled by its top 10 holders. The quantity of XRP controlled by the top 10 accounts is revealed in the table below.

| Account Name | Quantity Held | Percentage (%) | Address |

|---|---|---|---|

| Ripple | 1,960,027,012 XRP | 1.96% | View Address |

| Ripple | 1,765,294,075 XRP | 1.765% | View Address |

| Binance | 1,477,168,712 XRP | 1.477% | View Address |

| Uphold | 1,376,176,324 XRP | 1.376% | View Address |

| Binance | 845,049,785 XRP | 0.845% | View Address |

| Kraken | 770,000,042 XRP | 0.77% | View Address |

| bitbank | 684,680,659 XRP | 0.685% | View Address |

| Coincheck | 663,143,714 XRP | 0.663% | View Address |

| Ripple | 650,439,587 XRP | 0.651% | View Address |

| Unknown | 607,476,328 XRP | 0.608% | View Address |

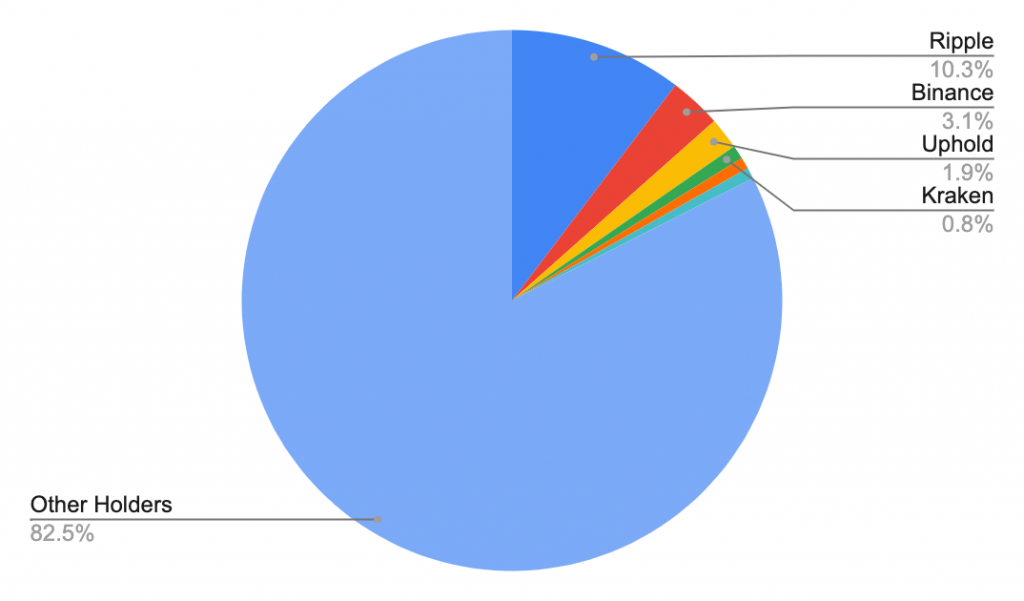

After examining the top accounts by XRP balance, especially the leading 10, it becomes evident that a considerable portion is held by Ripple’s founders and executives, such as Chris Larsen and Brad Garlinghouse. Centralized exchanges like Binance, Kraken, Uphold, Bitbank, and others also hold substantial amounts of XRP. These exchanges serve as custodians for their customers, securing XRP deposits in multiple addresses. Ripple, along with its founders, retains a significant stake in XRP as well.

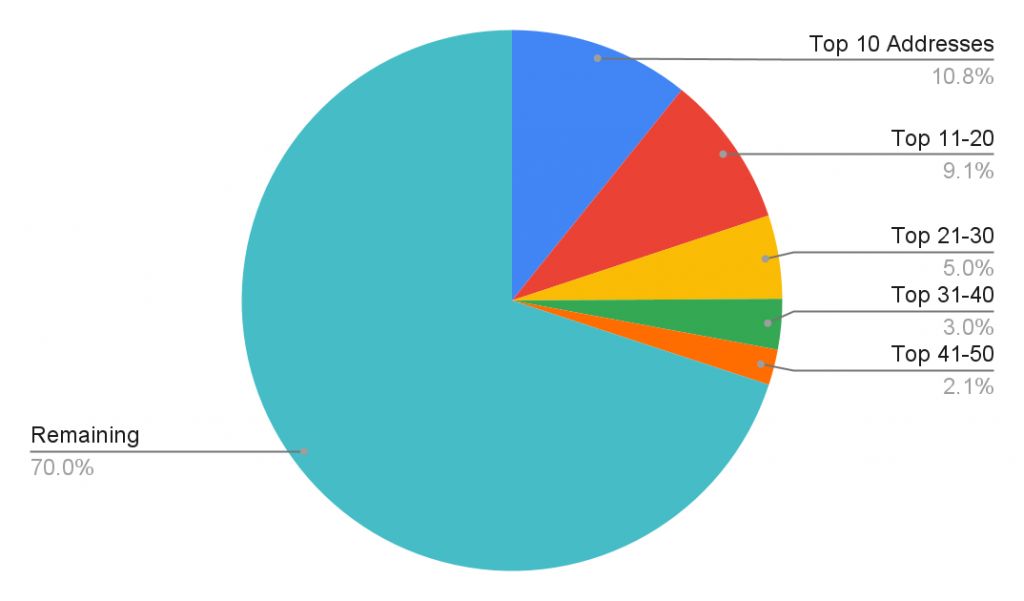

According to the data provided, the 10 addresses with the highest XRP holdings possess 10.8% of the available assets, amounting to around 10,799,456,238 XRP, equivalent to approximately $4.9 billion based on the current market rates. Furthermore, the subsequent 10 largest accounts on the XRP rich list account for approximately 9.113% of the total XRP available. However, the next 10 on the list, ranking from the top 21-30 addresses, are estimated to control about 4.987% of the total available XRP. This is followed by 3.018% and 2.122% with respect to the subsequent tens till the 50th largest address. The percentage of XRP held by the top accounts is represented in the above chart.

Nonetheless, a critical look into the 10 leading XRP accounts shows that the list typically comprises leading exchanges, including Binance, Uphold, Kraken, Bitbank, CoinCheck, and Ripple itself. Seeing that some of these exchanges possess more than one account on the Network, it may be pretty difficult to analyze the total XRP held by these exchanges and Ripple itself in all their accounts. Hence, here’s a pictorial representation of the total quantity of XRP controlled by these XRP whales using the data provided by XRPSCAN.

Ripple Founders and Their XRP Holdings

In a captivating turn of events, the XRP landscape has witnessed a significant shift as one of its prominent figures, Jed McCaleb, has nearly expanded his XRP reserves. McCaleb, popularly known as a co-founder of both Ripple and Stellar, has long been associated with the notorious “tacostand” wallet, notorious for flooding the market with millions of XRP on a daily basis. However, recent observations reveal that this once-overflowing wallet now holds a mere 47.69 XRP, marking a substantial decline.

Over the course of several years, the “tacostand” wallet regularly dispatched substantial quantities of XRP to various accounts engaged in selling the cryptocurrency, including an account on the Bitstamp exchange. While the precise amount of XRP involved in each transaction varied, it typically ranged from 1 million to 10 million XRP. A reliable source for tracking XRP movements indicates that McCaleb has been consistently offloading an average of 4.1 million XRP per day for about 3 months in mid-2022.

This significant reduction in McCaleb’s XRP holdings adds an intriguing layer to the overall narrative surrounding the original founders of the project. Initially, when the project was established, Chris Larsen, Jed McCaleb, and Arthur Brito had allotted themselves 20 billion XRP. Subsequently, McCaleb departed from the company in 2014, carrying away 9 billion XRP coins. Since then, he has been steadily liquidating his XRP holdings, eventually culminating in the recent sale of his entire remaining balance. This divestment process took McCaleb a noteworthy span of eight years to accomplish. In contrast, the other co-founders have opted to retain a substantial portion of their XRP holdings.

Among the co-founders, former CEO Chris Larsen stands out as one of the most prominent holders of XRP, possessing an impressive cache exceeding 5 billion XRP. Notably, five addresses directly traceable to Larsen contain a total of 2.5 billion XRP. As for the current CEO, Brad Garlinghouse, specific details regarding his XRP holdings remain undisclosed at this time.

How Does XRP Compare to BTC, ETH, and Other Popular Cryptos?

Let’s briefly examine the performance of the XRP rich list in 2023 and compare it to other popular cryptocurrencies in the market in terms of whale acquisitions.

Ripple (XRP)

- Retail investors primarily control most of the XRP supply of over 50 billion XRP, as evidenced by the majority of the supply being held on exchanges.

- There are 27 addresses with at least 500 million XRP. These addresses collectively hold more than 18.9 billion XRP, which represents 37.8% of the circulating supply.

Bitcoin (BTC)

- Only five addresses have over 100,000 BTC, controlling 799,181 BTC.

- 109 addresses have between 10,000 and 100,000 BTC, totaling almost 2.3 million BTC.

- 1,964 addresses have between 1,000 and 10,000 BTC, totaling 4.6 million BTC.

Notably, these addresses control about 7.7 million BTC, which is over 40% of the circulating supply.

Ethereum (ETH)

- Over 230 million Ethereum addresses hold 120.4 million Ether in circulation.

- 16.6% of the supply is locked in Ethereum staking.

- 3% (3.7 million ETH) is held in the Wrapped Ether contract.

- Several exchanges and Layer 2 networks hold significant portions of the ETH supply.

- The top 100 addresses hold about 41.5% of the supply.

- Over 1,200 addresses hold at least 10,000 ETH, accounting for over 70% of the total supply.

Dogecoin (DOGE)

- 100 addresses hold over 100 million DOGE, which is over 66% of the circulating supply.

Note, many of these addresses belong to exchanges, while some are owned by individuals.

Solana (SOL)

- The top 100 SOL holders have 33.29% of the overall supply, with the 100th address holding 604,707 SOL.

- The top ten wallets hold 10.78% of the assets, with the number one wallet holding 16.87 million coins.

Cardano (ADA)

- The top 10 ADA holders control 6.41% of the circulating supply.

- The top 100 wallets hold 18.97% of the circulating supply.

These comparisons are basically focused on the holdings of the top addresses and their percentage of the circulating supply. Hence, there is no specific token amount for all addresses.

XRP: Price History and Project Overview

Since its inception, XRP has emerged with varied price history. In 2012 when Ripple Labs created it, the asset was introduced to the market with a price of less than $0.01.

In 2017, it reached an all-time high of $3.84 during a crypto market bull run. However, it faced a decline in 2018 along with the overall market correction, which saw it trading around $0.35 as at the end of that year. In 2019, XRP saw increased adoption by financial institutions and partnerships which boosted its price to around $0.19 as the year wrapped up. Regulatory uncertainties in 2020 saw a lawsuit filed by the SEC against Ripple Labs, leading to a sharp decline in XRP’s price. By the end of 2020, XRP was trading around $0.22.

While it has struggled through the waves of regulatory scrutiny and a challenging market condition, XRP has retained its relevance and retrieved a slight spike in 2023. XRP is trading at around $0.42 as of the time of writing.

As for the blockchain technology behind XRP, it uses the XRP Ledger Consensus Protocol for transaction validation. It offers speed and scalability, settling transactions in seconds, making it suitable for real-time cross-border payments. RippleNet, a network of financial institutions, leverages XRP for liquidity and faster international payments. XRP also serves as a bridge currency. The blockchain’s performance has earned it a spotlight in the crypto market, attracting the interest of investors. Also, the market behavior of XRP’s price is attributable to factors such as market trends, investor sentiment, regulatory developments, and adoption by financial institutions.

Final Wrap

The XRP Rich List of 2023 has provided a fascinating glimpse into the world of XRP, the native cryptocurrency of the Ripple Network. As of 2023, XRP remains a valuable cryptocurrency despite regulatory challenges as the close evaluation of its whale revealed that retail and institutional investors are still holding on to the asset with up to 27 addresses holding a minimum of 500 million XRP. These addresses collectively hold more than 18.9 billion XRP, representing 37.8% of the circulating supply.

Among its peers, XRP stands out for its distribution and ownership patterns. While retail investors primarily control the majority of XRP supply, with a significant portion held on exchanges, some other cryptocurrencies have a higher concentration of wealth among smaller holders. For example, Bitcoin has a significant concentration of supply among a few addresses, with over 40% controlled by a limited number of accounts. Ethereum also exhibits a notable concentration of supply, with a significant portion held by exchanges and fewer addresses. In comparison, XRP’s distribution appears to be relatively more decentralized and widely held, which can be seen as a strength regarding broader participation and market stability.

The largest XRP holders include centralized exchanges like Binance and Ripple itself. The top 10 accounts control a significant portion of XRP, equivalent to billions of dollars. While it appears that Jed McCaleb, a co-founder of Ripple, has significantly reduced his XRP holdings, other co-founders seem to be holding on to the fate of the asset as the Ripple key figures, like Chris Larsen, still hold substantial amounts. Monitoring the XRP Rich List undoubtedly provides insights into wealth distribution within the network and the evolving landscape of digital assets.