The term “Forex God” is used to describe individuals who exhibit exceptional success in forex trading, consistently generating profitable trades. Engaging in forex trading can be a demanding and fulfilling endeavor that necessitates a blend of skills, knowledge, and self-discipline.

Nonetheless, there are certain traders who possess an extraordinary talent for consistently achieving profits in the foreign exchange market, earning them the moniker of “Forex Gods.” But what does this label truly signify, and is it based on factual evidence or mere speculation? In this article, we will delve into the concept of a Forex God and offer valuable advice for aspiring traders.

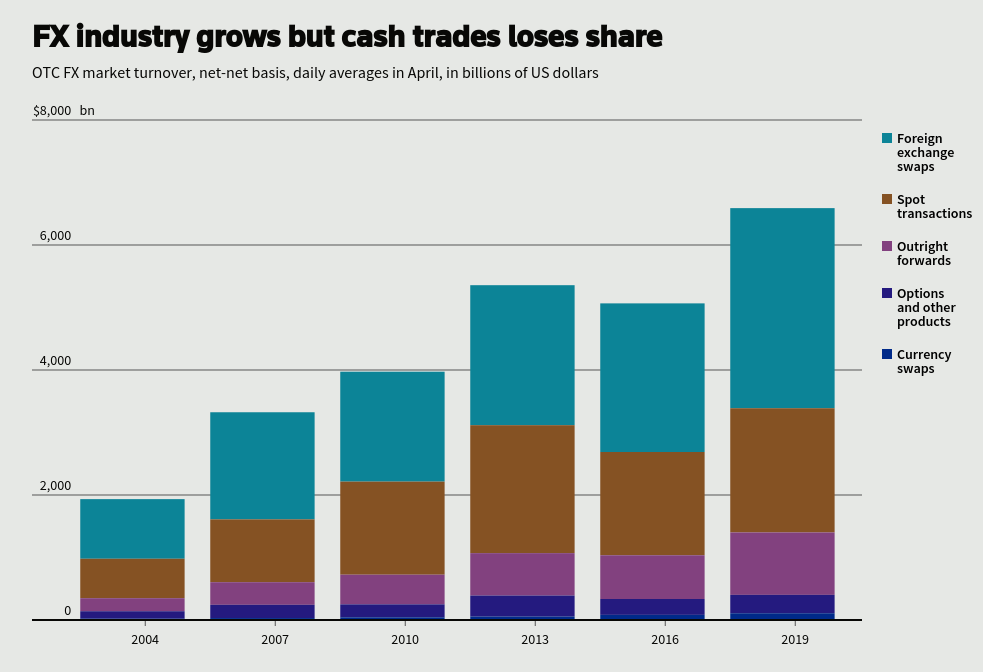

It is essential to acknowledge that forex is the most dynamic and extensive marketplace globally. In 2019 alone, forex traders exchanged a staggering $2.4 quadrillion in fiat currencies, surpassing the total value of all stocks in the world by nearly 26 times and exceeding the entire cryptocurrency market cap by over 1,800 times.

What is a Forex God? Demystifying the term

The term “Forex God” is not an official or widely recognized term in the world of forex trading. It’s something people might say casually to describe a trader who has achieved remarkable trading results. However, it’s important to understand that this term can create unrealistic expectations and lead to idolization.

Forex trading involves risks, and even the most successful traders can face losses or periods of reduced profits. It’s a challenging endeavor that requires knowledge and practice. Nevertheless, there are some common traits and habits that successful traders often possess. These traits can be learned and developed by anyone who is willing to put in the effort.

It’s important to be cautious about certain individuals who claim to be forex gods on social media. Some influencers use this title to market themselves, flaunting expensive cars and a luxurious lifestyle. However, it’s crucial to approach these claims with skepticism and not take them at face value. Many of these self-proclaimed forex gods may not have the expertise or track record to support their grandiose claims.

Want to become a Forex God? Use these forex trading strategies

Before diving into forex trading strategies, it’s best to examine traits that will help you become a profitable forex trader first. Successful forex traders often possess certain characteristics that contribute to their achievements in the market. Here are some key traits commonly associated with successful forex traders:

- Discipline: Successful traders exhibit a high level of discipline. They follow a well-defined trading plan, stick to their strategies, and avoid impulsive or emotional decision-making.

- Patience: Forex trading requires patience. Successful traders understand that not every trade will be profitable and are willing to wait for the right opportunities to maximize their gains.

- Risk management: Effective risk management is crucial in forex trading. Successful traders employ risk management techniques such as setting stop-loss orders and proper position sizing to protect their capital.

- Continuous learning: Forex markets are dynamic, and successful traders understand the importance of ongoing education. They stay updated on market trends, economic news, and technical analysis to make informed trading decisions.

- Adaptability: Successful traders can adapt to changing market conditions. They are open to adjusting their strategies and approaches as needed to align with market trends and volatility.

- Strong analytical skills: Forex trading requires analyzing vast amounts of information. Successful traders possess strong analytical skills, enabling them to interpret charts, indicators, and economic data effectively.

- Emotional control: Emotions can cloud judgment and lead to poor decision-making in trading. Successful traders maintain emotional control and avoid letting fear or greed dictate their actions.

While there are plenty of successful forex traders that don’t possess the above traits, it is more likely than not that profitable traders possess a strong sense of discipline, patience, risk management, and analytical skills – especially to achieve high profitability over the long term.

With that said, here are the strategies you can apply to make your forex trading lucrative:

Trend trading

This strategy involves identifying and trading in the direction of a prevailing market trend. Traders look for patterns and indicators that indicate the strength and sustainability of a trend, entering trades in the direction of the trend.

Range trading

Range trading involves identifying price levels where the currency pair has historically shown support and resistance. Traders buy at support levels and sell at resistance levels, aiming to profit from price oscillations within the range.

Breakout trading

Breakout traders focus on price levels where the currency pair breaks out of a range or a significant price level. They enter trades when the price breaks above resistance or below support, expecting a continuation of the price move in the breakout direction.

Scalping

Scalping is a short-term trading strategy that aims to profit from small price movements. Traders execute multiple trades throughout the day, taking advantage of small fluctuations in the market.

Carry trading

Carry trading involves taking advantage of interest rate differentials between two currencies. Traders buy a currency with a higher interest rate and sell a currency with a lower interest rate, earning the interest rate differential as a profit.

Swing trading

Swing trading is a medium-term strategy that aims to capture shorter-term price movements within larger trends. Traders hold positions for a few days to weeks, capitalizing on price swings during that period.

The bottom line: Instead of aiming to be a forex god, aim to be a disciplined and consistent trader

If you want to become a forex god with the aim of raking in huge profits, then you should probably adjust your expectations. While there are some individuals who manage to make vast sums of money finding foreign currency exchange rates, most traders aren’t able to. However, if you continue to learn, improve, practice with a demo account, and manage risks correctly, then you are well on your way to becoming a profitable forex trader.

It’s important to note that no strategy guarantees success in forex trading. Each strategy has its advantages and disadvantages, and traders should choose a strategy that aligns with their trading style, risk tolerance, and time commitment.

If you find considerable success in forex trading, you might be interested in using the best concierge service that allows you to focus on your trading and delegate various tasks to trained professionals.