Before we dive further, let’s address the elephant in the room – “Are NFTs dead?” No, they are not. However, the downturn in the NFT market over the past year has led to a considerable decrease in trading volume and NFT floor prices.

NFTs, or non-fungible tokens, are a unique piece of technology that allows immutable storing of ownership data on the blockchain. While the technology promises a unique value proposition – i.e., owning property in a digital world where everything can be copied – there have been few truly interesting services or products launched so far that fully leverage the potential the tech offers.

Instead, we got an endless series of JPEGs and tokenized gaming items that promise gamers ownership of skins and in-game items – but that’s not fundamentally different from owning a piece of in-game equipment that is not on the blockchain.

In this article, we are going to examine the current state of the NFT market and try to identify trends to see where the industry could be heading in the future.

Are NFTs dead? The rise and fall (and rise) of NFTs

No, NFTs are not dead. However, the trading volume and prices have taken a huge hit in the past couple of months. The main reason for the decline is the downturn in the crypto markets, but that’s not the only reason.

After the explosion in 2021, the general sentiment surrounding NFTs has soured a bit, especially among the mainstream audience and smaller retail investors, a lot of whom were hurt by a series of scams, rug pulls, and undelivered promises.

However, that’s not to say that all NFT projects are bad, far from it. For example, countless digital artists are monetizing their creations using NFTs, which gives them the ability to sell their own work, set prices, and, thanks to smart contracts, even earn royalties from any second-hand sales down the line.

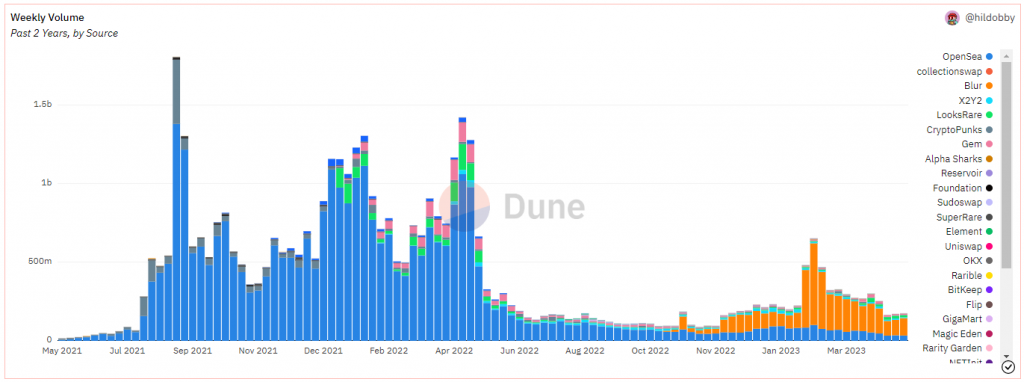

The launch of the Blur marketplace in late 2022 brought renewed interest in NFTs. Thanks to its zero trading fee approach, and a 0.5% minimum creator royalty, Blur has overtaken OpenSea as the world’s largest NFT marketplace.

There is a reason to be optimistic, though – the launch of the Blur marketplace in late 2022 saw renewed interest in NFTs. Blur is now the world’s largest NFT marketplace, displacing OpenSea’s multi-year reign thanks to its zero trading fee approach and a 0.5% minimum creator royalty.

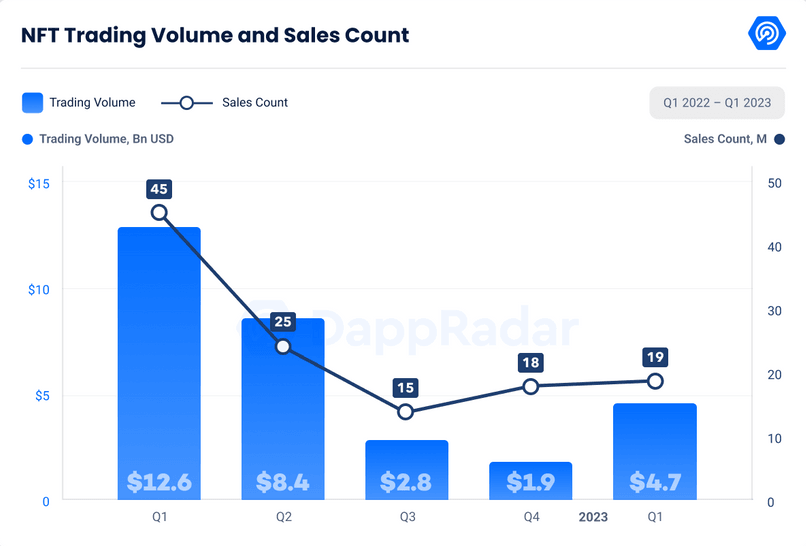

NFT market overview: A strong start to 2023

According to the Q1 2023 industry report from DappRadar, the NFT trading volume has picked up the pace considerably in the first quarter of this year compared to the last year’s closing quarter. In Q1, $4.7 billion worth of digital collectibles changed hands, up from $1.9 billion in Q4 2022 – a 147% quarter-over-quarter (Q/Q) increase.

Moreover, the total number of sales has also seen an increase, albeit a more modest one – 19 million sales took place in the last quarter, whereas 18 million sales occurred in Q4 2022.

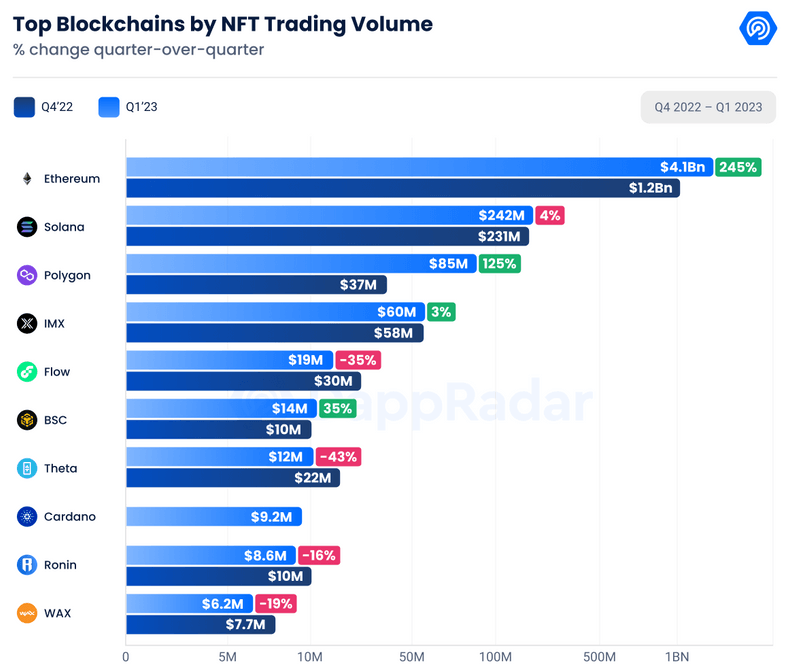

When it comes to which blockchain was the most popular for NFTs in Q1, there was no change. Ethereum holds a massive lead in that regard, with over $4.1 billion, or 87% of all volume taking place on the world’s leading layer 1 chain. Solana came in at second, with $242 million.

Among the “smaller” blockchains, Polygon saw the most impressive growth, with a Q/Q increase in trading volume of +125%. During the quarter, $84 million worth of NFTs changed hands on Polygon, up from $37 million in Q4 2022. A likely reason behind the surge was the rollout of Polygon support on Binance NFT, a native digital collectible marketplace of the world’s largest crypto exchange.

Bitcoin NFTs? Ordinals spike in popularity

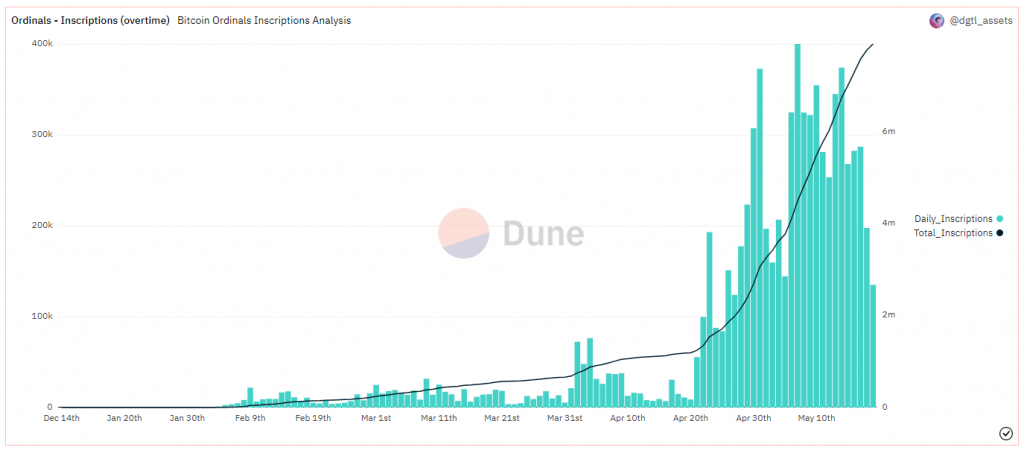

An interesting development over the past couple of months has been the growth of ordinals. Sparring technical details, ordinals are a system of digital artifacts that allow users to inscribe digital content (think images, audio files, etc.) on the Bitcoin blockchain. The Bitcoin Ordinals project was launched in early 2023 by Casey Rodarmor.

It is worth noting that ordinals are somewhat different from NFTs on Ethereum, BNB Chain, and other chains that use smart contracts to create non-fungible tokens. Bitcoin ordinals are inscribed on the Bitcoin blockchain itself and allow users to attach data to each satoshi (the smallest undividable unit of Bitcoin).

While the spike in Ordinals volume is certainly impressive, it is worth noting that the Bitcoin blockchain, due to its 7 TPS cap, is not the most ideal solution for NFTs, especially not for NFT-powered games that require a huge number of transactions and low fees to be usable.

At of the time of this writing, the trading volume of Bitcoin NFTs across several Ordinals marketplaces reached $145 million – not a small amount, but still far from being a large part of the overall NFT trading volume.

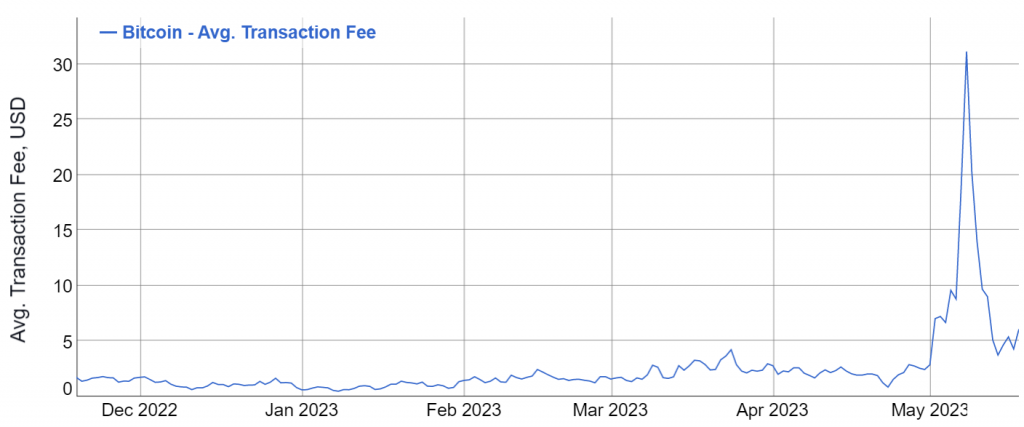

Another reason why Bitcoin NFTs might not have a bright future is Bitcoin fees. Just a few days ago, the fee for a single transaction on the Bitcoin blockchain surpassed $30. The increase was directly proportional to the increase of newly inscribed ordinals.

What could help fuel NFT growth in the future?

NFTs, once primarily associated with extravagant profile pictures, have the potential to extend far beyond their current use. With applications in digital art, music, gaming, and more, NFTs could experience a resurgence in popularity. Here are several reasons why NFTs are most likely here to stay:

Advancements in infrastructure

As the technology supporting NFTs continues to evolve and become more accessible, it has the potential to attract a broader audience of investors and buyers to the market.

Inherent scarcity

NFTs possess a unique characteristic – they are one-of-a-kind and cannot be replicated. This inherent scarcity adds value, and as demand for specific NFTs increases, their prices may surge due to limited supply.

Portfolio diversification

NFTs offer an opportunity to invest in digital assets, a relatively new and untapped area. Investors seeking to diversify their portfolios may consider including NFTs as part of their investment strategy.

Untapped market potential

While NFTs have gained significant attention in the realm of digital art and collectibles, their potential in other sectors, such as gaming, remains largely untapped (although several gaming companies have announced blockchain initiatives in the recent past). Unlocking these new applications could provide a substantial boost to NFTs in the future.

Mainstream acceptance

Increasingly, prominent artists and brands are embracing NFTs, creating and selling their own digital assets. As acceptance of NFTs grows, more individuals are likely to engage in buying and trading them, potentially driving up their value.

So, are NFTs dead?

While the future of NFTs remains uncertain, examining the state of the NFT market shows that NFTs are not dead. The trading volume has increased in the last couple of months, while new projects, like Bitcoin Ordinals, are pushing the boundaries of what’s possible.

Expanding use cases, improved accessibility and user experience, enhanced authenticity and security measures, and the establishment of regulatory frameworks are key factors that can drive the increased popularity of NFTs.